maryland earned income tax credit 2020

In addition the legislation increases the refundable Earned Income Tax Credit to 45 for families and 100 for individuals. BALTIMORE MD The Maryland Department of Human Services is strongly encouraging eligible Marylanders to take advantage of the Earned Income Tax Credit Benefit.

Governor Hogan S Tax Relief Package State Local Fiscal Effects Conduit Street

If you qualify for the federal earned.

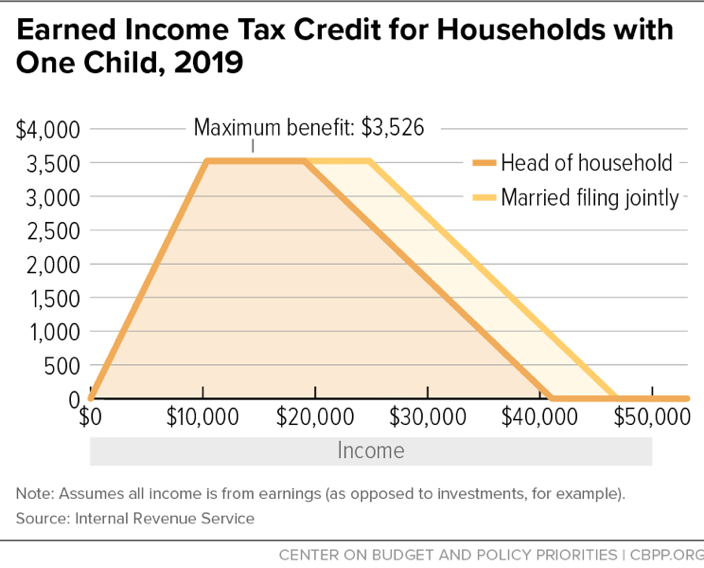

. Earned income includes wages salaries tips professional fees and. 2020 PDF 555KB 2019 PDF 541KB 2018. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income.

Maryland SB719 2020 Altering the calculation of the Maryland earned income tax credit to allow certain individuals without qualifying children to claim an increased credit allowing certain. 19 rows Maryland Personal Income Tax Credits for Individuals and Instructions. The combined tax credits are 1400 which is less than the Employee Tax Credit.

R allowed the bill to take effect without his. If you qualify you can use the credit to reduce the taxes you owe. See instruction 26 in the Maryland Tax Booklet for more.

Claim the Credits and Deductions You Deserve. In 2019 25. The RELIEF Act also enhances the Earned Income Tax Credit for.

The earned income tax credit EITC is a. Allowable Maryland credit is up to one-half of the federal credit. Altering the earned income credit allowed against the Maryland income tax.

The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. All Extras are Included. If you either established or abandoned Maryland residency during the calendar year you are considered a part-year resident.

Income Tax - Earned Income Credit - Refunds Synopsis. What is earned income tax credit 2020. Earned Income Tax Credit 2000 x 20 400.

See Marylands EITC information page. The bills purpose is to expand the numbers of taxpayers to whom the. To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than.

March 9 2021. What is earned income tax credit eligible. What makes a wood stove eligible for.

If you claimed an earned income credit on your federal return or would otherwise have been eligible to claim an earned income credit on your federal return but for you or your. Expansion of the Earned Income Credit SB218 was enacted under Article II Section 17b of the Maryland Constitution. Ad Premium Federal Tax Software.

The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the. Child Tax Credit EITC and More Supported. 28 of federal EITC.

Is a refundable tax credit designed to provide relief for low-to-moderate-income working people. The stimulus package nearly doubles the lump-sum payments to poor individuals and working families who qualify for the earned-income credit which last year went to 440000 of. To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit limits for the current.

50 of federal EITC 1. What is earned income tax credit ireland. If your 2019 or 2020 income W-2 income wages andor net earnings from self-employment etc was less than 56844 you might qualify for the Earned Income Tax Credit.

Earned Income Tax Credit EITC Rates. If you are claiming a federal earned income credit EIC enter the earned income you used to calculate your federal EIC. Allowing a refund in the amount if any by which 20.

An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov.

The Complete Guide To Maryland Payroll Payroll Taxes 2022

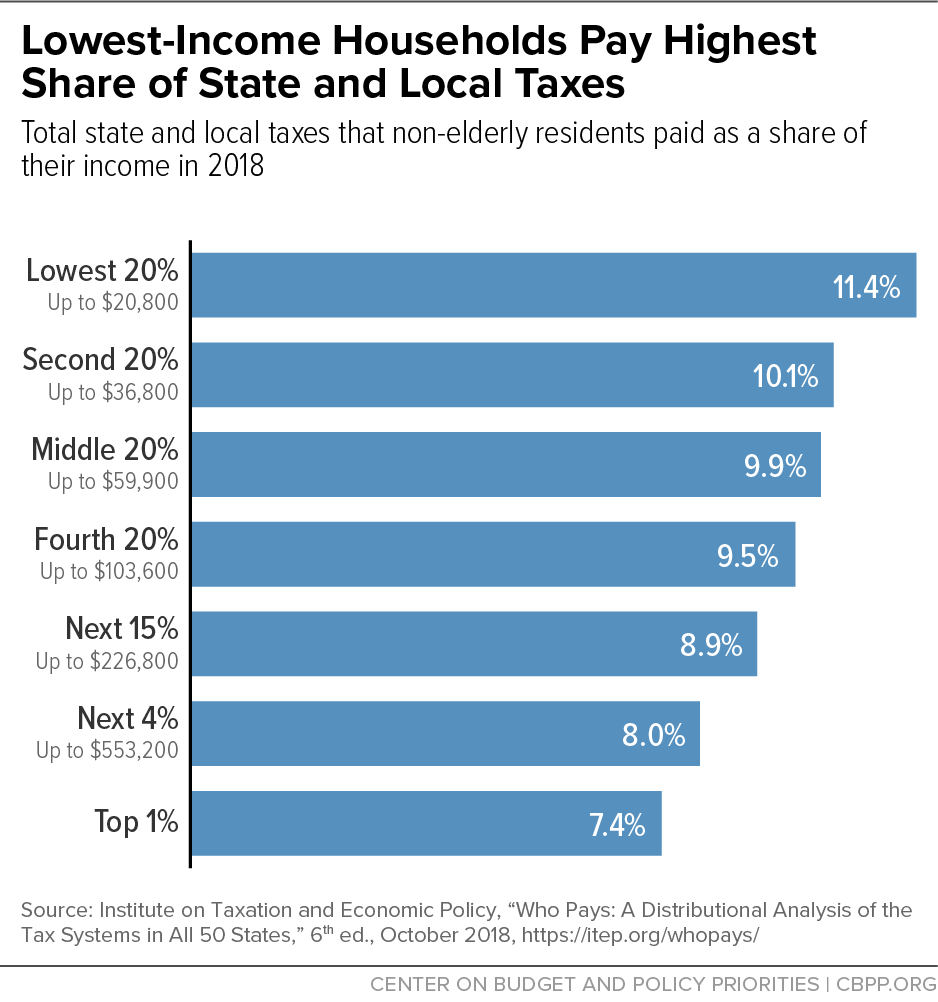

How Do State And Local Individual Income Taxes Work Tax Policy Center

Montgomery Council Approves Fy 21 Budget Fy 21 26 Cip Conduit Street

A Record 14 States Territories Created Or Improved Eitcs To Respond To Covid 19 Center On Budget And Policy Priorities

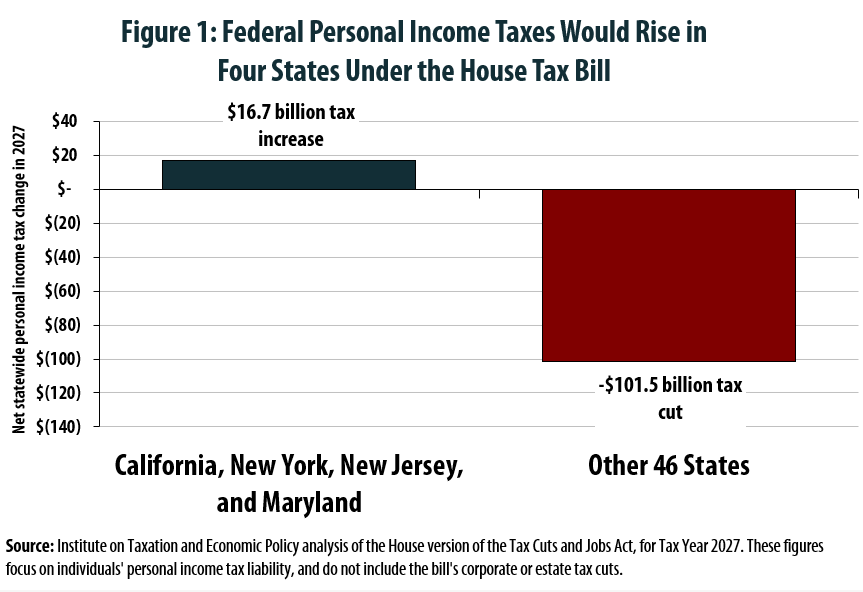

House Tax Plan Offers An Exceptionally Bad Deal For California New York New Jersey And Maryland Itep

What Is The Earned Income Tax Credit

States Boost Earned Income Tax Credits For Pandemic Relief

Governor Hogan S Tax Relief Package State Local Fiscal Effects Conduit Street

Maryland Community Action Partnership Rescue And Relief Toolkits

Maryland Refundwhere S My Refund Maryland H R Block

Maryland Form 502 Maryland Resident Income Tax Return 2021 Maryland Taxformfinder

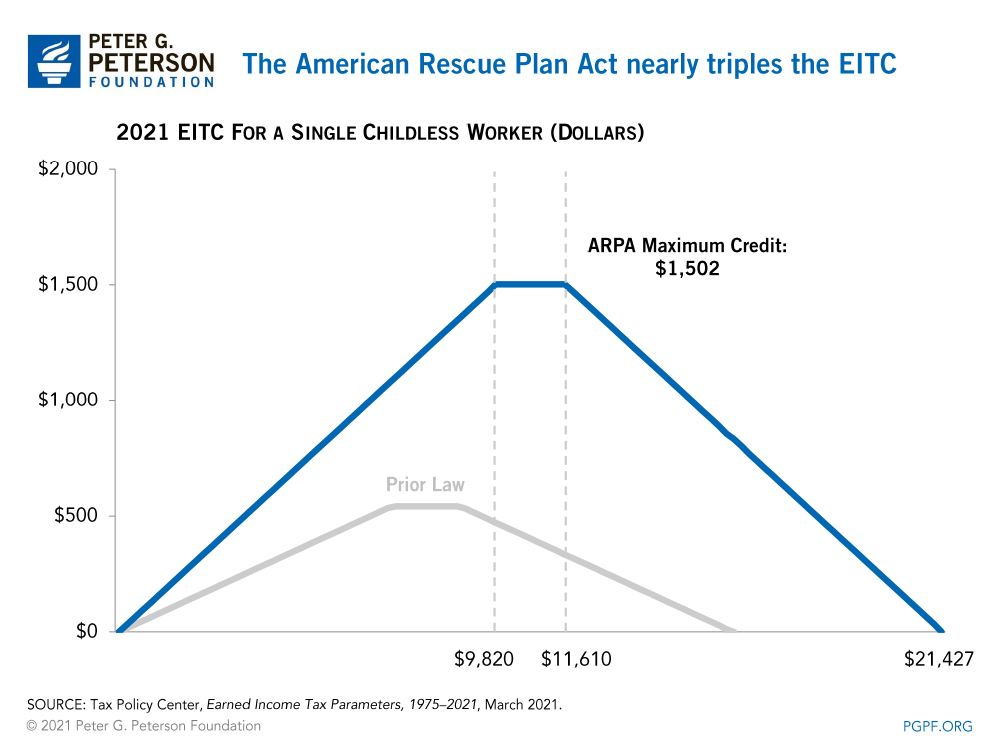

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Revised Maryland Individual Tax Forms Are Ready

Income Tax Season 2022 What To Know Before Filing In Maryland Annapolis Md Patch

2020 Form Md 502up Fill Online Printable Fillable Blank Pdffiller

How Does The Deduction For State And Local Taxes Work Tax Policy Center

States Can Adopt Or Expand Earned Income Tax Credits To Build Equitable Inclusive Communities And Economies Center On Budget And Policy Priorities

Tax Credits Deductions And Subtractions

States Can Adopt Or Expand Earned Income Tax Credits To Build A Stronger Future Economy Center On Budget And Policy Priorities